child tax credit october 2021

The IRS will soon allow claimants to adjust their. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the.

October Child Tax Credit Payment U S Gov Connect

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return.

. Ad Home of the Free Federal Tax Return. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. All eligible families could receive the full credit if.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. 1 day agoThe American Rescue Plan increased the Child Tax Credit from 2000 to 3600 per child for children under the age of six from 2000 to 3000 for children over the age of 6 and. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Families can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021. E-File Directly to the IRS.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. 3600 for children ages 5 and under at the end of 2021. IR-2021-201 October 15 2021.

The IRS has confirmed that theyll soon allow. E-File Your Tax Return Online. The total credit is as much as 3600 per child.

The Child Tax Credit reached 611 million children in. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Which was approved in 2021 expanded the usual child tax credit from 2000 per child. 152 PM EDT October 15 2021.

Ad Access IRS Tax Forms. October 17 is the tax filing deadline for those who requested an extension from the IRS. The new 2021 US.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The monthly payments were up to 250 or 300 per child for a period of.

As part of the. About 9 million people will get a letter from the IRS about missing stimulus check and enhanced Child Tax Credit payments. Learn More At AARP.

Changes in income filing status the birth or. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger.

All eligible families could receive the full credit if. New data proves how well it worked. IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that.

In Connecticut families can also claim 250 per child which is capped at three children - for a total of 750These payments started rolling out in late August. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October. Have been a US.

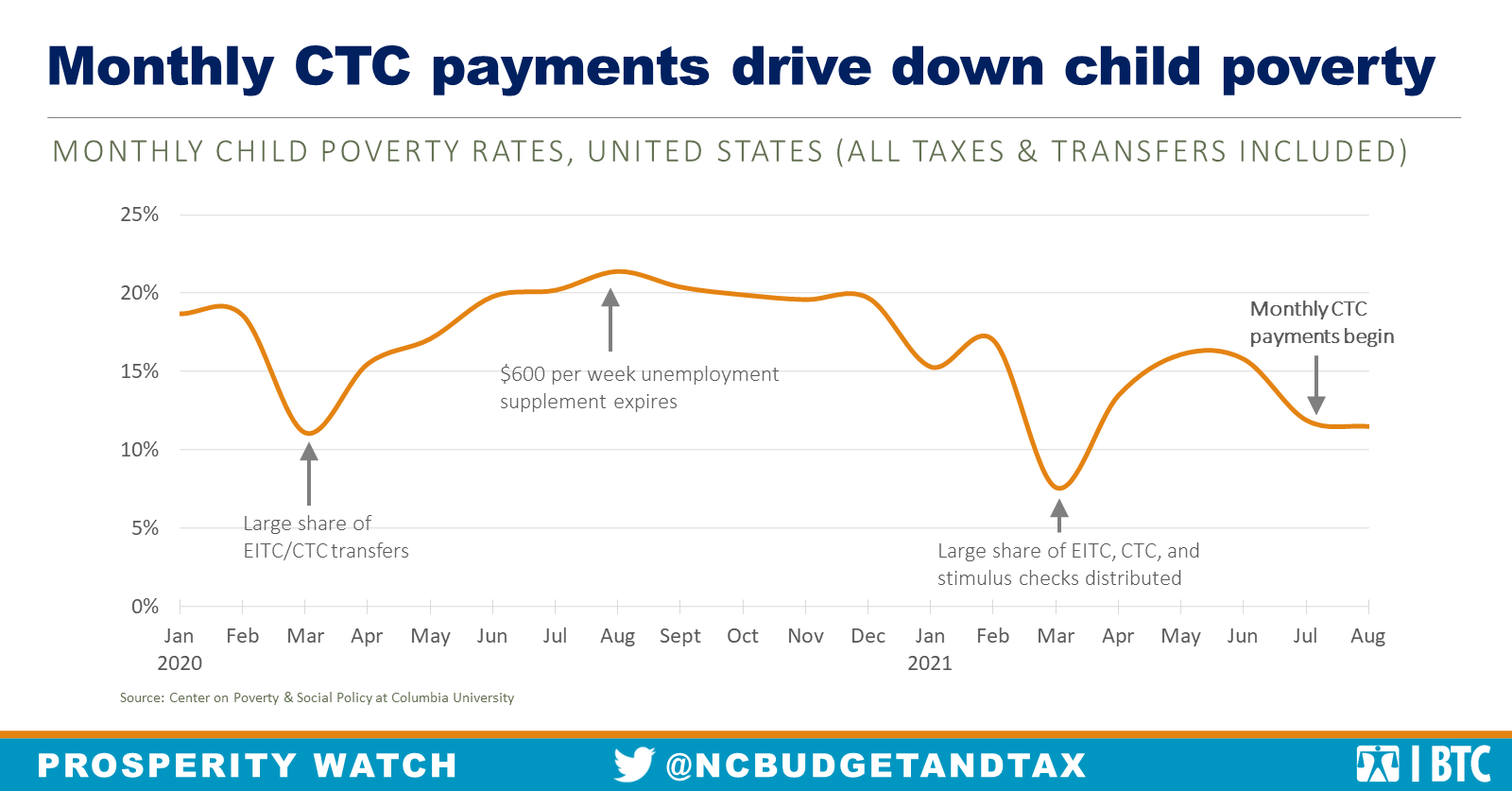

The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. October 17 is the deadline for filing 2021 tax returns if you. Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. Most families are eligible to receive the credit for their children. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is.

October 14 2022 249 PM UTC. Complete Edit or Print Tax Forms Instantly. 3000 for children ages 6.

For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered.

What Is The Child Tax Credit And How Much Of It Is Refundable

Irs Sending October Installment Of Child Tax Credit After Delay In September

Child Tax Credit File Your Taxes By October 17 To Claim Your 2021 Deduction Gobankingrates

Irs August Child Tax Credit Payment On The Way Kxl

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Advance Child Tax Credit Update October 8 2021 Youtube

Advance Child Tax Credit Update October 12 2021 Youtube

Child Tax Credit Payments Other Cash Benefits Lead To A Decrease In Child Poverty North Carolina Justice Center

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Training How To Best Serve And Connect Immigrants To The Child Tax Credit Get It Back

Advance Child Tax Credit Update October 15 2021 Youtube

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Taxpayer Advocate On Twitter If You Ve Moved Update Your Address By Midnight Eastern Time On October 4th To Change Your Mailing Address For Your October Advance Child Tax Credit Payment Use The

Child Tax Credit 2021 8 Things You Need To Know District Capital

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa